Navigating the complexities of UK income tax in 2025/26 requires informed strategies to optimise savings and ensure HMRC compliance. At Advantax Accountants, we offer a detailed guide tailored for employees, self-employed individuals, and business owners. Explore essential foundations including personal allowances, tax bands, and rates for England, Wales, Northern Ireland, and Scotland. Uncover insights on tax codes, multiple incomes, common traps like the high-income child benefit charge, and self-assessment. Delve into savings allowances, dividends, capital gains tax, ISAs, and pension planning. Concluding with 10 easy steps for effective UK income tax planning, this resource empowers you to reduce liabilities and enhance financial efficiency.

First Thing First – Getting the Foundations Right — Allowances, Bands & Rates

What are people usually looking for?

Picture this: You’ve got your P60 or your Self Assessment return, you’re staring at your pay or profits, and you think: “How much of this will HMRC actually take?”

You might be:

- An employee seeing your payslip and wondering if your tax code is correct

- Self-employed or a business owner wanting to check what profit is taxable

- Someone with multiple income streams (job + side gig + rental + pension) trying not to be caught out

- Someone who thinks they may be paying too much (or paying too little and might get a penalty

- Living in Scotland or Wales and hearing the tax bands there work differently

From years of sitting across the table from taxpayers, I can say: confusion comes from frozen thresholds, multiple income sources, and poorly explained HMRC guidance. Let’s clear it up using 2025/26 rules.

Key Figures for 2025/26 (England, Wales, Northern Ireland)

For most of the UK (outside Scotland), the tax structure is as follows:

| Item | Value for tax year 6 April 2025 – 5 April 2026 |

| Personal Allowance (tax-free income) | £12,570 |

| Basic Rate | 20% on income from £12,571 to £50,270 |

| Higher Rate | 40% on income from £50,271 to £125,140 |

| Additional Rate | 45% on income above £125,140 |

| Tapered allowance | Personal Allowance reduces £1 for every £2 earned over £100,000, vanishing completely at £125,140 |

Source: GOV.UK – Income Tax rates and Personal Allowances

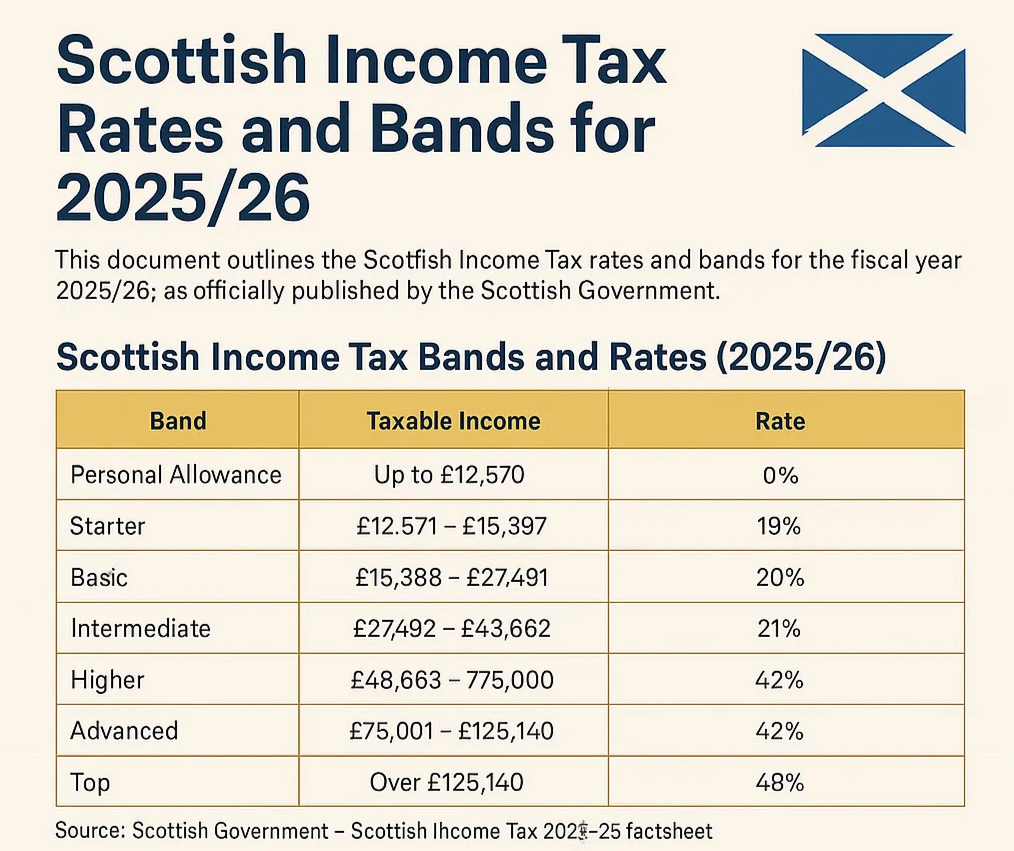

Scottish Income Tax — Different Bands & Rates

If you live in Scotland, things look very different because the Scottish Parliament sets its own income tax bands on earnings (non-savings, non-dividends).

Here are the official figures for 2025/26:

| Band | Taxable Income | Rate |

| Personal Allowance | Up to £12,570 | 0% |

| Starter | £12,571 – £15,397 | 19% |

| Basic | £15,398 – £27,491 | 20% |

| Intermediate | £27,492 – £43,662 | 21% |

| Higher | £43,663 – £75,000 | 42% |

| Advanced | £75,001 – £125,140 | 45% |

| Top | Over £125,140 | 48% |

Source: Scottish Government – Scottish Income Tax 2025-26 factsheet

Important note: Scottish rates apply only to earnings. Dividends and savings interest are still taxed under the UK-wide system.

Key Allowances Worth Checking

A few allowances are often overlooked in real cases:

- Marriage Allowance – lets one spouse/civil partner transfer up to £1,260 of their allowance if the other is a basic rate taxpayer.

- Blind Person’s Allowance – worth £3,130 for 2025/26.

- Dividend Allowance – £500 for 2025/26.

- Personal Savings Allowance – £1,000 for basic rate, £500 for higher rate, none for additional rate taxpayers. (GOV.UK)

National Insurance Contributions (NICs) — Don’t Forget These

NICs are collected alongside tax but follow different thresholds.

For 2025/26:

- Employees (Class 1): 8% on earnings £12,570–£50,270, then 2% above that.

- Self-employed (Class 4): 6% on profits £12,570–£50,270, then 2% above that.

- Class 2 (self-employed): now voluntary in most cases, £3.50 per week if you choose to pay.

Sources:

- GOV.UK – National Insurance rates and categories

- UK Parliament – Direct taxes: rates and allowances 2025/26

Step-by-Step Example: Employee in England

Scenario: Alice earns £60,000 salary

- Gross income: £60,000

- Deduct Personal Allowance: £60,000 − £12,570 = £47,430 taxable

- Apply bands:

- £37,700 taxed at 20% = £7,54

- £9,730 taxed at 40% = £3,892

- Income tax = £11,432

- £37,700 taxed at 20% = £7,54

- NIC:

- £37,700 × 8% = £3,016

- £9,730 × 2% = £195

- NIC = £3,211

- £37,700 × 8% = £3,016

- Total deductions = £14,643 → Take-home ≈ £45,357/year

Case Study: Mixed Income (Employment + Freelance + Rental)

Raj in Manchester earned in 2025/26:

- £30,000 employment

- £15,000 freelance profit

- £5,000 rental

Total £50,000. After allowance, all £37,430 is within basic rate → £7,486 tax. NICs apply separately: Class 1 on job, Class 4 on freelance profits, no NIC on rent.

Lesson: different income types feed into the same tax bands, but NIC rules vary by category.

Changes in 2025/26 You Need to Know

- Thresholds frozen – Personal Allowance and Higher Rate thresholds are unchanged, meaning more taxpayers pulled into higher bands. (Commons Library)

- Class 4 NIC cut – down to 6% (was 9%), reducing self-employed bills. (Commons Library)

- Class 2 NIC voluntary – many self-employed people are no longer required to pay, but you may need to pay voluntarily to protect State Pension. (GOV.UK)

- Scotland bands adjusted – Starter and Basic slightly higher, but Higher and above frozen, widening differences with the rest of the UK. (Scottish Government)

Tax Codes, Multiple Incomes & Common Traps

Why do tax codes matter so much?

Most PAYE taxpayers never think about their tax code until something looks odd on their payslip. But that little set of letters and numbers is how HMRC decides what to deduct from your salary each month. A mistake can easily mean you’re paying hundreds too much (or too little).

Common Tax Codes Explained

- 1257L – the standard code for 2025/26 if you’re entitled to the full £12,570 Personal Allowance.

- BR – all your income from this job is taxed at basic rate (20%), often applied to second jobs.

- 0T – no Personal Allowance, usually when your allowance is used elsewhere or you’ve not provided starter details.

- K codes – mean you owe tax from benefits in kind or underpaid tax, so extra tax is collected.

Multiple Jobs or Income Streams

If you’ve got more than one source of income, HMRC decides how your allowances are split:

- Your main job or pension usually gets the Personal Allowance.

- Other jobs/pensions are often taxed at BR (20%), D0 (40%), or D1 (45%).

- You can ask HMRC to allocate your allowance differently if it reduces overpayments.

Child Benefit High Income Charge

If you or your partner earns over £50,000, you may need to pay the High Income Child Benefit Charge (HICBC). This is often overlooked until HMRC sends a letter years later with backdated demands.

- Between £50,000 and £60,000 → you repay 1% of child benefit for every £100 above £50k.

- Above £60,000 → you repay it all.

Emergency Tax Codes & PAYE Adjustments

When HMRC doesn’t have full details, you may end up on an emergency tax code (often 1257L W1/M1). That means your allowance is given monthly without the cumulative adjustment, so you can overpay.

HMRC adjusts this when they get the correct info from your employer or from you.

Self Assessment & Side Income

If you have untaxed income (like freelancing, rentals, or investments), you usually need to complete a Self Assessment tax return.

Check if you need to: GOV.UK – Check if you need to send a tax return And file online here: GOV.UK – Self Assessment tax returns

Contractors, Freelancers & IR35

If you work through your own limited company, IR35 rules may apply. In some cases, your client must decide if you’re really employed for tax purposes.

Case Study: PAYE + Freelance + Child Benefit

Sophie earns:

- £40,000 from employment (PAYE)

- £15,000 freelance profit (self-employed)

- Claims Child Benefit for 2 kids

Impact:

- PAYE tax deducted monthly on her salary.

- She must register for Self Assessment to report freelance profits and the Child Benefit charge (since income > £50k).

- Her code may be adjusted the following year, but the return is the official requirement.

Practical Steps to Avoid Problems

- Check your tax code every year and after changing jobs.

→ GOV.UK – Check your Income Tax for the current year - Tell HMRC about side income early to avoid penalties.

→ GOV.UK – Tell HMRC about self-employment - File returns on time – the penalties add up quickly.

→ GOV.UK – Self Assessment tax returns - Check if Child Benefit charge applies if anyone in your household earns over £50k.

Savings, Dividends, Capital Gains & Pensions

Savings Income

Not all interest is taxed equally. Depending on your income level, you may qualify for tax-free allowances:

- Personal Savings Allowance – £1,000 for basic rate taxpayers, £500 for higher rate, none for additional rate.

- Starting Rate for Savings – up to £5,000 of interest can be tax-free if your non-savings income is below £17,570.

- Banks usually deduct nothing now, as most interest is reported directly to HMRC.

Dividends

If you own shares (including in your own company), dividends are taxed differently:

- Dividend Allowance – £500 tax-free for 2025/26.

- Above this:

- 8.75% for basic rate taxpayers

- 33.75% for higher rate

- 39.35% for additional rate

- 8.75% for basic rate taxpayers

Capital Gains Tax (CGT)

If you sell assets like property, shares, or crypto, you may pay CGT.

- Annual exempt amount – £3,000 for 2025/26.

- Rates:

- 10% or 20% (for most assets, depending on your Income Tax band).

- 18% or 24% on residential property (except main home).

- 10% or 20% (for most assets, depending on your Income Tax band).

GOV.UK – Capital Gains Tax rates and allowances

ISAs (Tax-Free Savings & Investments)

Money held in an ISA is completely tax-free: no Income Tax, no Dividend Tax, no CGT.

- ISA limit = £20,000 per year.

- Types: Cash ISA, Stocks & Shares ISA, Innovative Finance ISA, Lifetime ISA.

Pensions (Tax Relief & Limits)

Pensions are one of the most tax-efficient ways to save:

- Tax relief – contributions usually get basic rate relief at source, and higher/additional rate taxpayers claim extra via Self Assessment.

- Annual Allowance – £60,000 per year (tapered down for very high earners).

Lifetime Allowance – abolished from 6 April 2024, but new limits apply to certain lump sums.

GOV.UK – Tax on your State Pension

Case Study 1: Dividends + Salary

Emma runs her own limited company and takes:

- £9,000 salary

- £30,000 dividends

Outcome:

- Salary is below NIC thresholds (minimal NIC).

- £9,000 uses part of her Personal Allowance.

- £3,570 of allowance left, covers first £3,570 of dividends.

- Next £500 covered by Dividend Allowance.

- Balance taxed at 8.75%.

Case Study 2: Selling a Second Property

James sells a buy-to-let property making a £50,000 gain.

- £3,000 exempt (annual allowance).

- Remaining £47,000 taxable at 18% or 24% depending on his income level.

- Must report and pay within 60 days of completion.

GOV.UK – Report and pay Capital Gains Tax on UK property

Case Study 3: Savings & Pensions Interaction

Maria earns £16,000 from work and has £1,000 savings interest.

- She qualifies for the starting rate for savings (up to £5,000).

- All her savings interest is tax-free.

- She also contributes £3,000 to a pension, which gets tax relief.

GOV.UK – Tax on savings interest

???????? UK Income Tax Calculator

Calculate your Income Tax and National Insurance for 2024-25 Tax Year

Gross Annual Salary

Total Tax & NI

Net Annual Salary

Monthly Take Home

Tax Breakdown Visualization

How to Plan Your UK Income Tax for 2025/26 in 10 Easy Steps

Planning your UK income tax for the 2025/26 tax year can seem daunting, but with the right approach, you can optimise your finances, reduce your tax liability, and ensure compliance with HMRC rules. Whether you’re an employee, self-employed individual, or business owner, effective UK income tax planning for 2025/26 involves understanding allowances, bands, and reliefs to make informed decisions. This guide outlines 10 easy steps to help you navigate UK tax planning strategies, maximise savings, and avoid common pitfalls. By following these tax planning steps in the UK, you’ll be better positioned to handle your personal allowance, higher rate thresholds, and more.

Step 1: Assess Your Current Income Sources and Tax Position

Begin your UK income tax planning for 2025/26 by reviewing all your income streams. This includes salary, self-employment profits, rental income, dividends, and pensions. Calculate your total taxable income and compare it against the 2025/26 tax bands: basic rate at 20% from £12,571 to £50,270, higher rate at 40% up to £125,140, and additional rate at 45% beyond that. For Scottish residents, factor in the unique bands like the 19% starter rate and 48% top rate. Use your previous year’s tax return or payslips to identify if you’re close to thresholds where your personal allowance tapers. This initial assessment helps spot opportunities to shift income or claim reliefs, ensuring you don’t overpay tax unnecessarily.

Step 2: Maximise Your Personal Allowance

The personal allowance remains frozen at £12,570 for 2025/26, meaning income up to this amount is tax-free. To optimise this in your UK tax planning, ensure you’re not losing it through tapering, which starts at £100,000 income and disappears at £125,140. If your earnings exceed £100,000, consider salary sacrifice schemes or pension contributions to reduce your adjusted net income. For couples, explore transferring unused allowance via the marriage allowance, worth up to £252 in tax savings. Blind persons can claim an extra £3,130. By fully utilising this allowance, you lay a strong foundation for reducing your overall UK income tax bill in 2025/26.

Step 3: Understand and Apply Tax Reliefs and Deductions

Tax reliefs are key to effective UK income tax planning for 2025/26. Identify deductions like business expenses for self-employed individuals, including home office costs, travel, and equipment. Employees can claim relief on uniforms or professional subscriptions. Don’t overlook gift aid on charitable donations, which boosts your contribution by reclaiming basic rate tax. For higher rate taxpayers, additional relief can be claimed on self-assessment. Property owners should deduct allowable expenses from rental income before tax. By meticulously tracking and applying these reliefs, you can significantly lower your taxable income, making your tax planning more efficient and compliant with HMRC guidelines.

Step 4: Boost Pension Contributions for Tax Efficiency

Pensions offer one of the most powerful tools in UK tax planning strategies for 2025/26. Contributions receive tax relief at your marginal rate—20% for basic, 40% for higher, and 45% for additional rate taxpayers. The annual allowance is £60,000 or your earnings, whichever is lower, with carry-forward options for unused amounts from previous years. Employer schemes often include matching contributions, amplifying savings. For those over 55, consider accessing pension funds tax-efficiently. By increasing contributions, you not only build retirement wealth but also defer tax, potentially dropping into a lower band post-retirement. This step is essential for long-term financial security.

Step 5: Leverage ISAs and Savings Allowances

Individual Savings Accounts (ISAs) are a cornerstone of tax-free saving in the UK. For 2025/26, the ISA allowance is £20,000, covering cash, stocks and shares, or innovative finance ISAs, with all growth and income tax-free. Combine this with the personal savings allowance: £1,000 for basic rate taxpayers and £500 for higher rate, allowing tax-free interest. If you’re an additional rate taxpayer, focus solely on ISAs to avoid tax on savings. Junior ISAs for children offer £9,000 annually. By shifting savings into ISAs, you protect your wealth from income tax and capital gains, enhancing your overall UK income tax planning effectiveness.

Step 6: Manage Dividend and Investment Income Wisely

With the dividend allowance reduced to £500 for 2025/26, careful management is crucial in your tax planning steps. Dividends above this are taxed at 8.75% for basic rate, 33.75% for higher, and 39.35% for additional rate. Hold investments in tax-efficient wrappers like ISAs or pensions to minimise exposure. For business owners, consider extracting profits as salary instead of dividends if it optimises National Insurance and tax. Review your portfolio to realise gains within the £3,000 capital gains allowance. Timing disposals around tax year ends can prevent bunching income into higher bands, ensuring a balanced approach to UK income tax for investments.

Step 7: Claim Eligible Family and Marriage Allowances

Family-focused reliefs can provide substantial savings in UK income tax planning for 2025/26. The marriage allowance allows transfer of £1,260 of personal allowance between spouses or civil partners, saving up to £252 if one earns below £12,570 and the other is a basic rate taxpayer. For families, child benefit remains available but is clawed back via the high-income child benefit charge for incomes over £60,000, fully withdrawn at £80,000. Plan by adjusting pension contributions to stay below thresholds. Blind person’s allowance or carer’s credit can also apply. These steps ensure you’re not missing out on entitlements that reduce your net tax liability.

Step 8: Incorporate National Insurance Planning

While separate from income tax, National Insurance (NI) impacts your overall take-home pay. For 2025/26, employees pay 8% on earnings between £12,570 and £50,270, dropping to 2% above. Self-employed face 6% Class 4 on profits in that band, plus voluntary Class 2. Optimise by structuring income—perhaps through company dividends for directors to avoid NI. Ensure you’re building state pension entitlement with sufficient NI credits. Gaps can be filled voluntarily. By integrating NI into your UK tax planning, you achieve comprehensive savings, particularly if self-employed or running a limited company.

Step 9: Maintain Accurate Records and Use Digital Tools

Robust record-keeping is vital for seamless UK income tax planning in 2025/26. Track all receipts, invoices, and bank statements digitally using apps like QuickBooks or HMRC’s online portal. This simplifies self-assessment filing by 31 January 2027 and reduces error risks that could lead to penalties. For businesses, comply with Making Tax Digital requirements. Regularly reconcile accounts to spot discrepancies early. Good records also support claims for reliefs and deductions, providing evidence during HMRC enquiries. This proactive step not only ensures compliance but also empowers better decision-making throughout the tax year.

Step 10: Review Annually and Seek Expert Guidance

Finally, make annual reviews a habit in your UK income tax planning for 2025/26. Life changes like job switches, marriages, or property purchases can alter your tax position. Reassess mid-year to adjust strategies, such as increasing pension top-ups before April. While these steps provide a solid framework, complex situations—multiple incomes, overseas elements, or inheritance—benefit from professional advice. Accountants can uncover bespoke opportunities, like enterprise investment schemes for higher relief. Staying informed on budget updates ensures your plan remains optimal, helping you navigate UK tax rules confidently and minimise your liability legally.

By implementing these 10 easy steps, you’ll master UK income tax planning for 2025/26, potentially saving thousands while staying compliant. Remember, proactive planning turns tax from a burden into an opportunity for financial growth.

FAQs

Q1: Can someone change their tax code if it’s obviously incorrect?

A1: Yes — and in practice, it’s essential. In my experience with clients, the key is to use HMRC’s online “Check your Income Tax for the current year” service to see what tax code is assigned, then compare that with your payslips, P45s, and any benefits or untaxed income. If it’s wrong (for example, an employer still using a basic 1257L when you’ve started a second job, or you have a benefit in kind that’s not included), you notify HMRC. They issue a revised code and tell your employer to adjust deductions going forward. It may result in either a refund or reduced future deductions.

Q2: What happens if someone has two (or more) jobs — how does tax code work then?

A2: Having multiple jobs is more common than many realise, and it’s a common source of overpaying. The system expects you to pick one job as the “main job” — usually the one paying the most — which uses your Personal Allowance (1257L or equivalent). The second job(s) typically get code BR, D0, or D1, which give no allowance and tax all earnings from that job at basic/higher/additional rate immediately. If the code allocation is suboptimal (e.g. the lower income job is treated as the main one), you can ask HMRC to reassign, to minimise over-collection.

Q3: In what situations will someone be put on an emergency tax code, and how can they fix it?

A3: Emergency tax codes show up often when you start a new job and don’t provide a P45 or complete all your income/employment history, or when HMRC hasn’t yet got hold of benefit-in-kind or secondary earnings info. With my clients, I’ve seen temp workers or freelancers suffer this. To fix it: provide your previous employment details, income estimates, and info on other jobs/pensions via HMRC’s starter checklist or through your Personal Tax Account. Once received, HMRC should issue the correct code and you’ll get credit via recalculation or refunds.

Q4: Can someone claim a tax refund if they overpaid due to multiple income sources?

A4: Absolutely. If your tax withholdings during the year (via PAYE codes on multiple jobs) have led to overpayment, you can check this via HMRC’s “Income Tax: introduction / Check you’re paying the right amount” service. If confirmed, you can apply for a refund. In one case I handled, a client in Bristol with part-time work plus freelancing hadn’t told HMRC about freelancing early; he overpaid by ~£600, which he got back once he filed a Self Assessment and updated his PAYE codes.

Q5: What are the tax implications for someone working remotely from the UK but for an overseas employer?

A5: If you’re tax resident in the UK and working remotely even for an overseas employer, you are generally liable to UK Income Tax on your earnings. What matters more is residency, domicile, and where the work is performed. If tax is deducted abroad, there may be double tax relief but you’ll need to declare overseas earnings and possibly get credits. One client in Newcastle was employed by a US company; she got taxed in the UK for her full UK-period earnings, but got relief for the foreign tax paid once she lodged her SA return.

Q6: What if someone’s income fluctuates significantly year to year, especially freelancers — how do they avoid being pulled into a higher rate unexpectedly?

A6: This is a big trap. Because thresholds are frozen, even modest inflation or extra months of work can push someone into a higher rate. To manage this, freelancers should forecast their full year profit early, set aside tax in advance, and consider spreading work if possible. Also, making pension contributions can reduce taxable income. I advise clients to use a mini-worksheet: estimate current earnings + expected, subtract allowable expenses + pension contributions → see where you end up. If you’re getting close to higher rate, consider accelerating deductible expenses before the year end.

Q7: How does the High Income Child Benefit Charge (HICBC) work if one partner earns over threshold?

A7: If either partner earns more than £50,000, the one who receives Child Benefit must pay back via HICBC, a clawback via Self Assessment. The more they earn above £50,000 (up to £60,000), the more % of benefit must be repaid; above £60,000 the full amount. In practice, many people don’t realise until they do their SA return. One couple in Leeds saw over £1,500 of benefit clawed back because the higher-earning spouse had received shares income they hadn’t considered part of their earnings. Always include all taxable income (employment + dividends + rental + gains) in calculating whether you pass the threshold.

Q8: What special tax rules apply in Scotland vs England/Wales/Northern Ireland that someone might miss?

A8: Scotland has more bands and rates for non-savings, non-dividend income set by the Scottish Government. So someone earning say £45,000 in Edinburgh will have a different tax mix than someone earning same in Cardiff or London. Also, some allowances or thresholds (e.g., Income Tax rates) differ, though personal allowance is UK-wide. I’ve seen clients assume their Scottish “basic rate” income is taxed same as England’s; result: underestimating tax by several hundred pounds. If you live in Scotland, always check the Scottish bands for your taxable employment income.

Q9: How does the “Personal Allowance taper” work if somebody earns over £100,000?

A9: The taper reduces your Personal Allowance by £1 for every £2 you earn above £100,000. Once income hits around £125,140, your allowance drops to zero. That means the marginal tax rate in that band is effectively higher (same income increment taxed not just at 40% or 45%, but after losing part of allowance). One business owner client in Surrey had income estimated near £110,000, but didn’t budget for this taper; extra tax due was more than expected, because for every extra £2 earned, you lose £1 allowance → extra tax on that lost allowance. Always run a calculation if you expect earnings just above £100,000.

Q10: Can business expenses sometimes be disallowed leading to surprises in a Self Assessment?

A10: Yes, many business owners assume all outgoings are acceptable, but HMRC has specific rules. For example, travel expenses are typically allowed, but commuting is not. Using home as an office: you must only claim the proportion used for business, and evidence matters. One client in Birmingham tried to claim >50% of home utility bills, but HMRC said only a small portion (based on room usage and hours) was reasonable. Also, entertainment, non-wholly and exclusively business meals etc. can be disallowed. Always keep good receipts, logs, and be conservative.

Q11: What are “payments on account” for Self Assessment, and when do they apply?

A11: Payments on account are advance payments towards your next year’s tax bill. If you’re Self Assessment and your last bill was over £1,000 (and less than 80% taken at source), HMRC requires two payments on account: one by 31 January, the second by 31 July. Inexperience with this often leads to cashflow crunches. For example, a freelance graphic designer in Devon had to make the second payment in July and her July was tight; she had budgeted for one but forgot the other. You can reduce them if you believe your upcoming year will be lower, but you must justify the estimate.

Q12: Does someone with rental income need to do anything particular to ensure tax is correctly declared?

A12: Rental income must be declared via Self Assessment, less allowable expenses (repairs, insurance, agent fees, etc.). Key pitfalls: failing to include “wear and tear” (for let-furnished) only applies in some cases, depreciation is not allowed, and interest costs were restricted (for buy-to-let) some years ago. Also, if property is jointly owned, the split of rental profits matters. I’ve had landlord clients in Manchester who failed to declare income earned via holiday lets or Airbnb, thinking “because it’s occasional” it’s exempt — but exceptions are narrow. Always keep detailed letting income records; declare all rental income in year earned.

Q13: What about savings and investment interest — can someone end up paying unexpected tax because of multiple small incomes?

A13: Yes, especially when they don’t consider that savings interest (above Personal Savings Allowance) combines with other incomes for their marginal rate. If someone has modest salary + savings + maybe dividends, the extra interest might be taxed at a higher rate if their total taxable income surpasses thresholds. Also, some savings accounts deduct no tax at source, but that doesn’t mean it’s tax-free. In one case, a retiree in Glasgow had moderate pension + savings income; because his pension pushed him over a threshold, some of his interest became taxable when he didn’t expect it. Best to run totals of all income streams and check where allowances run out.

Q14: Can someone avoid underpayment penalties when they discover they owe more tax mid-year?

A14: Yes, you can mitigate penalties if you act early. If mid-year you realise additional income (freelancing, second job, investments) is significant, you can estimate extra tax owed and either adjust your PAYE code or arrange a voluntary payment to HMRC (or via Self Assessment). This helps avoid large bills or interest/penalties at year end. I once advised a client in Brighton who had freelance earnings part-way through year; they made a voluntary payment, then claim back at following Self Assessment — it reduced surprises and kept behavior clean with HMRC.

Q15: Do pension contributions always reduce taxable income, and is there a cap?

A15: Generally, yes — contributions into approved pension schemes reduce taxable income, saving tax at your marginal rate. But there are limits: the Annual Allowance (how much you can contribute and still get full tax relief) and carry-forward rules if you didn’t use full allowance in prior years. Also, for high-earners, there is tapering of the Annual Allowance. If you exceed the limit, excess contributions lose relief or are taxed. For example, a client earning ~£200,000 had to check how much pension input he could do without hitting taper thresholds.

Q16: What is the treatment of capital gains for UK residents with foreign property or assets?

A16: UK residents are generally liable to UK Capital Gains Tax on worldwide assets (once disposed), even foreign property, though double tax treaties or foreign tax paid can reduce liability. Gains must be calculated after allowable costs, then taxed depending on whether the asset is residential or non-residential. If foreign taxes paid on the gain, you may claim credit. A client from Sussex sold a property in Spain; she computed gain in local currency, converted to pounds on correct dates, then declared in SA; she also got credit for Spanish tax paid, reducing her UK bill.

Q17: If someone switches from employment to self-employment mid-year, how do they manage the tax overlap or gaps?

A17: That transition can create confusing overlaps. Essentially, from the date employment stops and self-employment begins, you may have PAYE already deducted, but new income will be taxed via Self Assessment. It’s critical to estimate annual income, report both sources correctly, and account for NIC which changes (you’ll begin Class 2/4). In a case I handled, a client left a job in September, started freelancing. Because he didn’t report freelancing until the SA deadline, HMRC assumed higher earnings and applied wrong bands; advance planning meant smoother cashflow and accurate deductions.

Q18: How does the UK tax code handle benefits-in-kind (like company car or health insurance), and what surprises do business owners often face?

A18: Benefits-in-kind are taxable and often push people into higher tax bands without generating cash in hand to pay them. If your employer provides a car, private medical, or other perks, HMRC assigns a “benefit value” which is added to your taxable income. Many business owners think these are small and ignore them; I’ve seen clients hit with unexpectedly high tax because they didn’t anticipate the “tax cost” of a company car’s CO2 emissions band, or the value of private fuel. Always look at the P11D or equivalent statements, estimate what added income means for your band, and plan for it (perhaps via salary sacrifice etc.).

Q19: What steps should someone take if they discover an underpayment of tax from past years?

A19: First, work out the amount owed via past payslips/self assessment records, combining all income types. Then check the limitation period — usually 4 years for income tax (though under certains conditions up to 6 years). File amended/self-assessment returns if needed. Pay interest and possibly penalties. In my practice, I had a client in Cardiff who found out (via P800) that HMRC under-collected tax because he’d forgotten dividend income over a couple of years; he had to pay for multiple years but avoided penalties by showing it was unintentional and by prompt amendment.

Q20: Are there specific reliefs or allowances often overlooked by business owners that can reduce Income Tax liability?

A20: Yes, and missing them can cost. Some common ones: capital allowances for equipment, business mileage, home-office costs, R&D credits (if qualifying), and relief for losses carried forward or back (depending on structure). Also don’t forget Marriage Allowance if you qualify, Gift Aid donation relief, or if you employ staff, you might have employment allowance or reliefs. I had a small cafe owner in Bristol who neglected to claim eligible capital allowances on kitchen equipment; when that was corrected, it reduced his taxable profits by several thousand and saved tax significantly.

Disclaimer

The information provided in this article on UK Income Tax and Planning is intended for general guidance purposes only and does not constitute professional tax, financial, or legal advice. At Advantax Accountants, we strive to offer accurate and up-to-date insights based on current HMRC regulations and tax laws as of the date of publication. However, tax rules, allowances, rates, and thresholds can change frequently due to government budgets, legislative updates, or other factors, and may vary depending on individual circumstances such as residency status, income sources, or specific relief entitlements.

We strongly recommend that you do not rely solely on this content for making financial decisions. Instead, seek personalised advice from a qualified accountant or tax advisor who can assess your unique situation. Advantax Accountants accepts no responsibility or liability for any loss, damage, or inconvenience arising from the use of, or reliance upon, the information contained herein. This includes, but is not limited to, errors, omissions, or inaccuracies that may occur despite our best efforts to maintain reliability.

For tailored UK income tax planning assistance, including self-assessment support, relief claims, or compliance with Making Tax Digital, please contact Advantax Accountants directly to discuss your needs. Remember, proactive professional consultation is key to optimising your tax position while ensuring full adherence to UK tax obligations.