As an employer, British National Insurance is a tax that enters the national fund based on the amount you pay to employees and National Insurance Contributions (NIC) to fund certain national welfare and public sector services. Although NIC is also paid by employees and self-employed individuals, this guide focuses on the amount of national insurance that you as an employer must pay as a business on behalf of your employees.

How to Calculate Employee’s National Insurance?

For each of your full-time or part-time employees, you will have a national insurance category letter, which you need to use when submitting payroll and processing payroll. This helps you calculate how much you need to contribute to each employee. Many employees fall into the A category. However, according to the personal situation of employees, you can also classify them into other categories, including:

- Type B

Married professional women and widows are entitled to reduced national insurance.

- Type C

Employees who have exceeded the current retirement age.

- Type J

Allow employers to defer NIC because they are paying them through another job, for example. Self-employment income.

- Class H

Apprentices under 25 years of age.

- Type M

Employees under 21 years of age.

- Type Z

Employees under the age of 21 may postpone the issuance of NICs because they pay them through other jobs.

Cost System

The work-related cost system allows employers to provide certain tax exemption benefits such as travel allowances, education costs, lunch boxes, and Christmas baskets. If the total amount is less than 1.5% of labor costs, the employer can offer these items tax-free. If their sum exceeds 1.5%, the employer will be required to pay 80% tax on the excess.

Employee Insurance Contributions

The employer also pays the employee a premium. These donations fund the Unemployment Allowance Program (WW), Disability Insurance Program (WAO), and Work Fit Program (WIA). The employer pays these contributions himself rather than withdrawing them from the employee’s wages. The government sets payment levels twice a year in January and July.

What if I have Multiple Jobs?

In addition to paying taxes for your second job, you may also have to pay National Health Insurance (NIC) for your second income. However, the operation of the National Health Insurance is different from that of the income tax. Including taxes, everyone can benefit from tax relief for each tax year. When it comes to National Health Insurance, as long as the employer is different, there are individual restrictions for each job. The limit is £ 184 per week (2021/22).

Unless you are a member of the company’s board of directors, each of your jobs will generally be considered individually for network card purposes. This means that the threshold for each task is completely low, but you can pay for the network card for each task. However, if your employer is online, for example, if you work in two different branches of a supermarket, you must add the income from the NIC. If you are not sure whether your work is relevant, you should ask your employer.

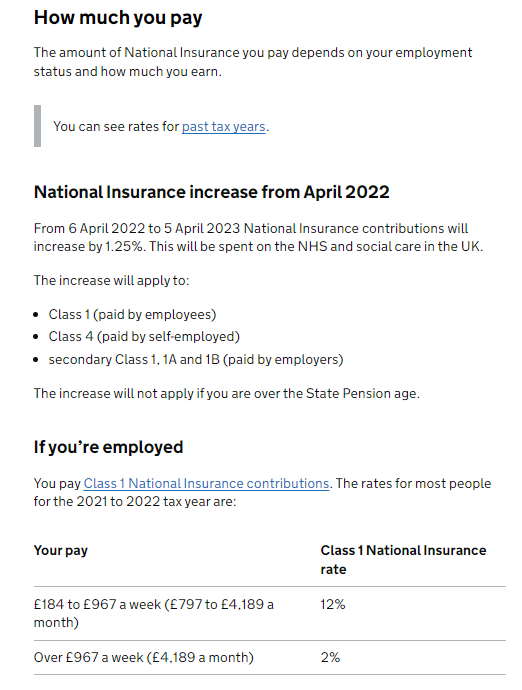

Your National Insurance Obligations as an Employer

As an employer, you are obligated to deduct Type 1 major contributions from the employee’s income on behalf of the employee-these are also called employee contributions. In addition, employers must pay Type 1 secondary contributions for their employees’ income. You must also make Class 1A contributions for most taxable benefits and expenses. These are only paid by the employer. If any of your employees have entered into a PAYE settlement agreement (“ASP”), you must pay only the employer’s Type 1B contributions, not the Type 1 or 1A contributions that should be due. When you make a pay-as-you-go (“PAYE”) payment every month (or quarterly, as the case may be), you must pay HMRC the primary and secondary contributions in full and on time.

You must keep a register of contributions deducted from each employee and submit a year-end return for each employee. Details of Category 1A contributions for benefits and expenses must be returned on Form P11D (b) by July 6th after the end of the tax year. If paid electronically, the Class 1A dues must be actually paid to HMRC by July 22 after the end of the fiscal year, otherwise, the deadline is July 19. Class 1B contributions must be calculated based on the items included in the PSA that your employees may need to comply with. If paid electronically, Class 1B dues must be paid to HMRC by October 22nd after the end of the fiscal year, otherwise, the deadline is October 19th. You must provide P60 to each employee by May 31st after the end of the fiscal year to show their national insurance contributions.