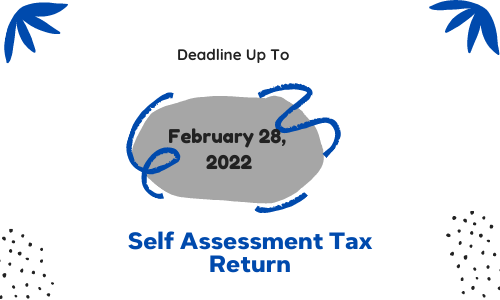

Well, yes it has. The government has extended the self-assessment tax returns deadline to 28th Feb. 2022.

HMRC announced last week that it has extended the deadline for submitting self-assessment to February 28, 2022, in an effort to reduce pressure on accountants and officers who are unable to reach their full potential due to the increase in Covid 19 cases because of the Omicron variant.

The move came after Angela MacDonald, HMRC’s deputy executive director, said:

“We know the pressures individuals and businesses are again facing this year, due to impacts of Covid 19. Our decision to waive penalties for one month for Self-Assessment Taxpayers will give them extra time to meet their obligations without worrying about receiving a penalty.”

This completes a statement by Treasury Secretary Lucy Fraser who says that eliminating the financial burden on households will help protect the subsistence level for the next few months 12.2 million have already submitted their tax returns in self-assessment.

However, keep in mind that only the deadline for submitting the tax return has been brought forward and not the deadline for submitting the self-assessment, which remains on 31 January 2022 each year, with an interest rate of 2.75%. No interest will be charged if a person does not pay their taxes on time but has agreed to a payment deadline before April 1, 2022.

The fiscal year since 2020 is unique because of government subsidies and exemptions to address the corporate financial crisis. It is therefore a clearly stated category that all types of income and income from recent years, including in the form of government grants, are taxable and therefore must be included in the tax return for the validity of the tax return.

Contributions are a form of non -refundable income and are therefore a special feature of loans, but since they remain a form of income, they are subject to income tax. The same is true for all self-employed income support programs and crown maintenance programs. However, a one-time payment of £ 500 for working families receiving a tax credit is exempt from self-assessment.

Extending the self-assessment deadline makes it easier for many to find an accountant to do the work at a busy but important time of the year. The additional 28 days given by the government will give taxpayers more time to pay their bills. Accountants also benefit from this expansion as they have more time and space to work more efficiently.